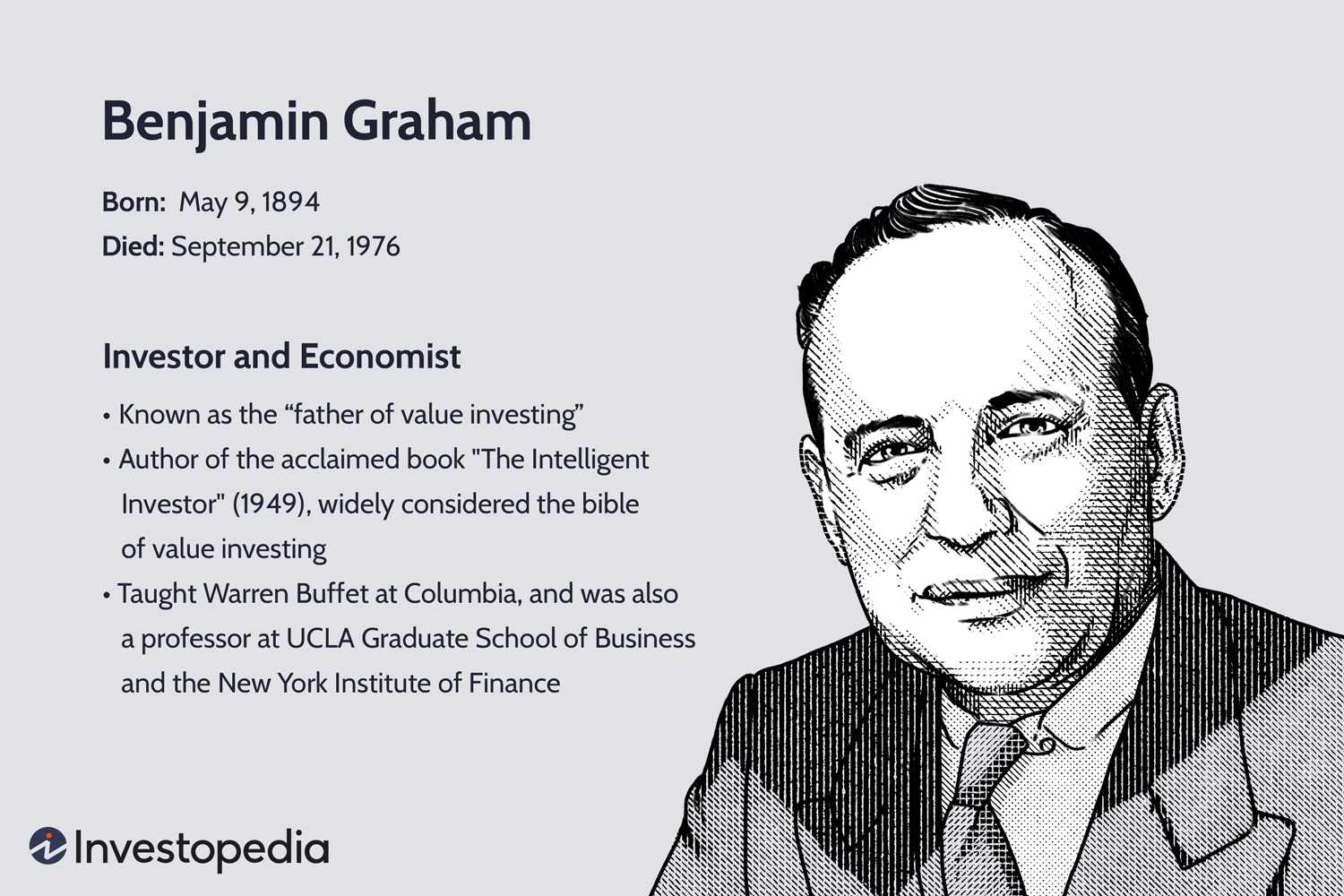

The Bible of Value Investing: Book Notes from Graham and Dodd’s “Security Analysis"

The future is inherently uncertain, so we must have an adequate margin of safety.

The future is inherently uncertain, so we must have an adequate margin of safety.

Four factors to consider when picking securities

- The general future for corporate profits. Macro changes will affect future profit trajectory, e.g. consumers moving from railroads to automobiles, and its effect on railroad earnings

- The differential in quality between a company and another

- Influence of interest rates on dividend or earnings return

- Timing and margin of safety. But since timing never works, we must resolve to the adequate margin of safety.

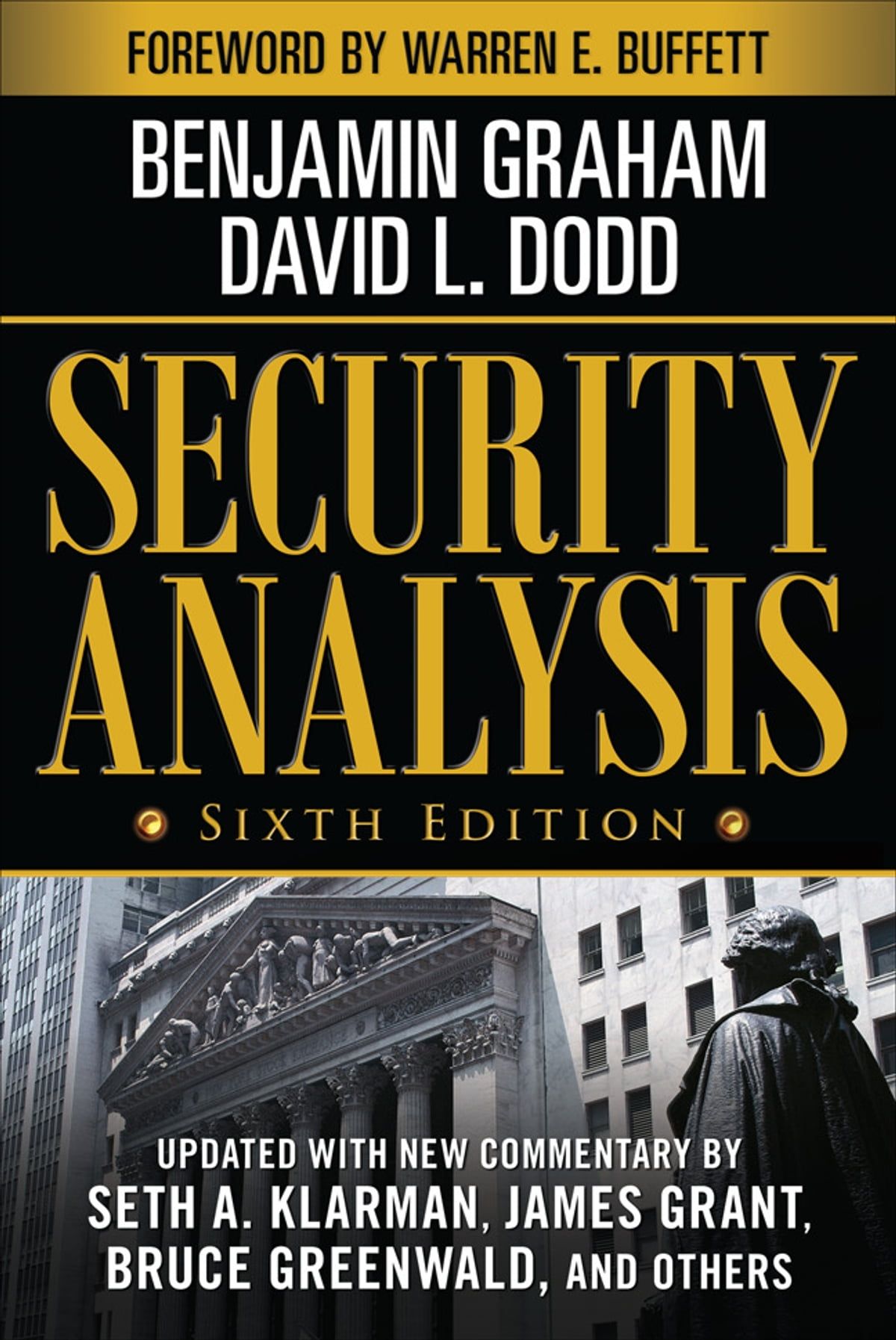

Security Analysis: Sixth Edition, Foreword by Warren Buffett

By Benjamin Graham and David Le Fevre Dodd

We can attain a satisfactory margin of safety by purchasing at a price lower than the book value (or possibly even the cash-debt threshold).

Read through competitors’ reports, and understand them.

Understand the industry. We can anticipate a company’s information by examining its competitors since there is usually more data available on them than the company itself.

Conduct on-foot research, visit shops, use their products, and talk to employees.

Don’t trust the management, especially their investor’s presentations (aka their “sales pitch”), they will often lie, overstate, or understate.

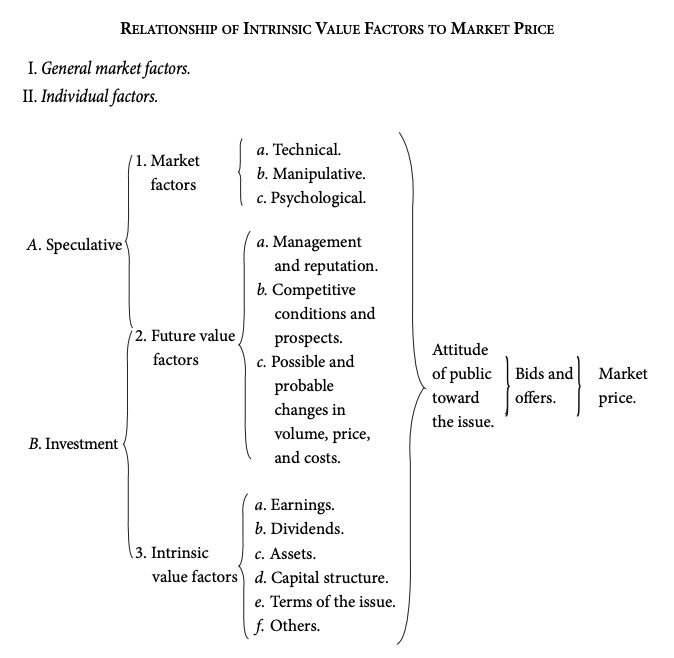

The intrinsic value is an elusive concept, it is not a fixed value, but rather a range of possible outcomes.

The future is inherently unpredictable. While past performance can offer some insight into what may happen, we must be mindful of uncertainty and maintain a significant margin of safety. Relying solely on historical extrapolation is imprudent. Instead, it’s crucial to be aggressively pessimistic for the bearish and base-case scenarios.

Graham advised investors to avoid undervalued stocks that are consistently overlooked by the market and emphasized the importance of catalysts in unlocking the true value of a company. He recommended focusing on undervalued stocks with identifiable catalysts instead of investing in undervalued stocks without such catalysts.

Be extra cautious during bear markets or at times of great uncertainties since the value of companies could change during the time you wait for a certain catalyst or the market to “rationalise”. (i.e. the intrinsic value of the company might change before the price changes).

Valuable industry research information can be obtained from sources such as the Department of Commerce’s Survey of Current Business and the Biennial Census of Manufacturers.

A good investment is one that, upon thorough analysis, promises the safety of the principal value and a satisfactory return. Investments not meeting these requirements are speculative.

A speculator is fully aware of the risks associated with their investment and is willing to take those risks in hopes of earning a large return. In contrast, an investor may not be aware of all the risks associated with their investment, but they are still exposed to those risks. Therefore, investors should be cautious when analysing potential investments to minimize their exposure to risks.

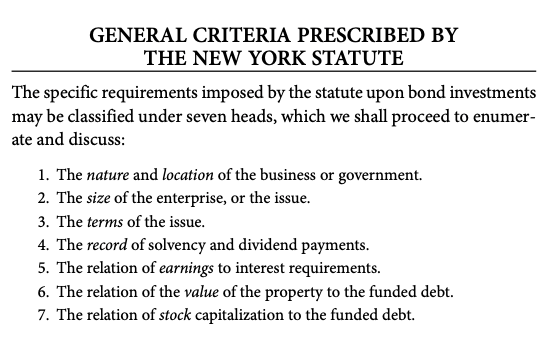

Given that bonds have limited returns, the approach to finding suitable bonds involves discarding those that do not meet your requirements, rather than actively seeking out good ones. Additionally, it is recommended to avoid purchasing bonds even with a hint of doubt about their suitability.

The safety of a bond is determined by the issuer’s ability to fulfil all obligations, not just during normal times but particularly during economic depressions.

High yield cannot compensate for deficient safety in an investment unless the investment is thoroughly diversified!

On earnings

- Accounting aspect: What are the true earnings for the period studied?

- Business aspect: What indications does the earnings record carry to the future earnings power of the company

- Retained earnings vs net income. (Retained earnings refer to the portion of a company’s profits that is not distributed to shareholders as dividends but instead is kept within the company for reinvestment in the business.)

- Negative operating cash flow vs positive net income. Negative operating cash flow may indicate possible fraud, inefficiencies, or overstatement of the net income.

- Sometimes idle assets may drag the company’s earnings (unused factory plants that cost the company taxes, depreciation, and other expenses)

Some companies may write off deferred charges against their surplus (or retained earnings), rather than against their net income. This makes the company’s net income appear higher than it actually is, as the deferred charges are not being subtracted from net income in the current period.

In the first instance, deduct any losses from its subsidiaries in the first instance. If these losses are significant, the analyst should investigate whether they may be subject to early termination. The analyst should consider whether the subsidiary’s losses contribute significantly to the main business’s profits or if they are useless components that may be terminated. If the examination is favourable, the analyst may treat all or part of the subsidiary’s loss as the equivalent of a nonrecurring item or include their profits in the analysis. (p452)

Deficits should be considered a qualitative rather than a quantitative factor. For instance, if Company A lost -$5 per share and Company B lost -$7 per share, but Company B’s shares outstanding increased by 2x, then the loss per share for Company B would be -$3.5. This seems contradictory because even though it appears to result in a lower EPS loss, dilution is still negative. (p481)

Don’t be scared of irregular earnings, research why that is the case, is it from non-recurring items, or others? (p483)

Some earnings are transitory and might be short-lived due to external factors such as competition, regulations, and changes in the market structure (e.g. cosmetics and fashion changes). (p485)

Always account for warrants or other items that will increase shares outstanding. Do not consider normal shares outstanding as EPS (linking back to using a margin of safety).

Be wary of the capital structure of the company. Bonds and preferred shares will “dilute” the earnings power of the common shares through bond interests, preferred stock interests/dilutions etc.

Use tangible book value, not intangible (p549)

The difference between a security analyst and a technical analyst is that the security analyst has a margin of safety. (p700)