Rich Dad Poor Dad by Robert Kiyosaki — Book Summary and Notes

Having two dads offered Robert T. Kiyosaki the luxury of observing the effects of two contrasting perspectives: the Poor Dad, and the Rich Dad.

Having two dads offered Robert T. Kiyosaki the luxury of observing the effects of two contrasting perspectives:

- A Stanford-educated PhD who followed the traditional career pathway was allergic to risk and financially illiterate (the Poor Dad, his biological father).

- A High school dropout who built a multimillion business (the Rich Dad, his best friend’s father).

The Poor Dad represents the traditional view on work and money — go to school, get a good job, climb the ladder, prize stability over independence, buy a house, and spend money without a clear long-term plan.

The Rich Dad represents a more contrarian view — work for salary if you have to, but gradually aim for financial independence; have you money generate more money; and take calculated risks boldly.

The Book in Three Sentences 🎯:

- Most people never win because they're more afraid of losing.

- The poor and the middle class work for money. The rich have money to work for them.

- Traditional schools focus on academic and professional skills, not on financial skills.

Rich Dad Poor Dad

What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! By Robert Kiyosaki

Lesson 1: The Rich Don't Work For Money

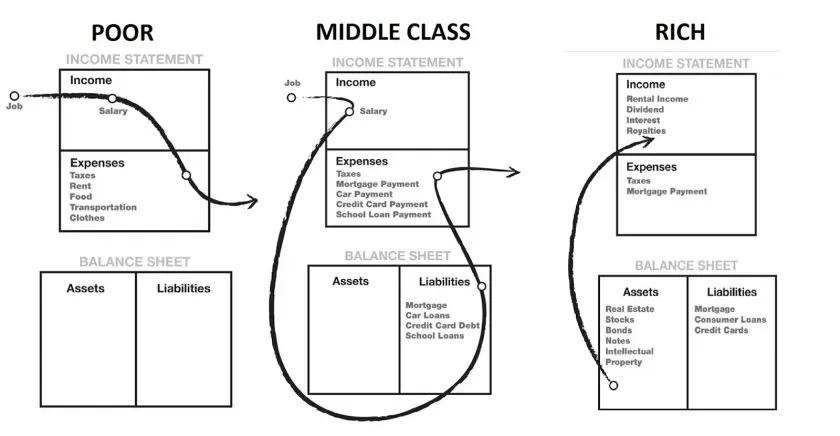

The poor and the middle class work for money. The rich have money work for them.

Schools focus on academic and professional skills, not on financial skills. We often got told that money was not important, that if we excelled in our education, the money would follow. What is missing from a student's education is not how to make money, but how to manage money, it's called financial aptitude

- What to spend the money once you make it?

- How to keep it longer?

- How to make that money world hard for you?

It's why people might end up successful in their professions but still struggle with money. They've learned how to work hard for money, but not how to make their money work hard for them.

"You can live all your life playing it safe, doing the right things, saving yourself for some event that never happens. You'll have lots of friends who really like you because you were such a nice hardworking guy. But the truth is that you let life push you into submission."

Lesson 2 : Buy Assets, Not Liabilities

Rich people acquire assets. The poor and middle class acquire liabilities that they believe are assets.

Every dollar you spend today is a dollar that does not work for you again, in perpetuity.

Lesson 3: Mind Your Own Business

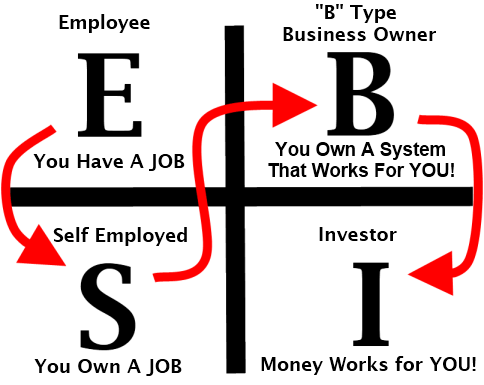

Mind your business. Don't spend your whole life working for someone to achieve their dreams.

1. You Work for the Company

Employees make their business owner or the shareholders rich, not themselves. Your efforts and success will help provide for the owner's success and retirement.

2. You Work for the Government

The government takes its share from your pay cheque before you even see it. By working harder, you simply increase the amount of taxes taken by the government.

3. You Work for the Bank

After taxes, your next largest expense is usually your mortgage and credit-card debt.

True luxury is a reward for investing and developing a real asset.

- Let assets generate enough income to cover luxuries.

- Think creatively about what your business is, not your profession.

- Acquire the type of assets you love; because you will take better care of them and enjoy learning about them.

Lesson 4: The Power of Corporations

Every time people try to punish the rich, the don't simply comply. They react. They have the money, power, and intent to create change.

Business Owners with Corporations

1. Earn.

2. Spend.

3. Pay Taxes.

Employees Who Work for Corporations

1. Earn.

2. Pay Taxes.

3. Spend.

Lesson 5: Work to Learn—Don't Work for Money

Job security meant everything to my poor dad; Learning meant everything to my rich dad.

The world is filled with talented poor people. They focus on perfecting their skills in building a better hamburger than the skills of selling and delivering the hamburger. Maybe McDonald's does not make the best hamburger, but they are the best at selling and delivering a basic average burger.

Important Management Skills for Success:

1. Management of Cash Flow.

2. Management of Systems.

3. Management of People.

4. Sales and Marketing Skills.

"Workers work had enough to not be fired, and owners pay just enough so that worker's won't quit."

- It may not make sense to leave a promising job for another, but the skills you will gain will lead to greater numbers in the long run.

- Learning skills outside what you think of as your profession will benefit you.

- The situation you fear most is the skill that you need to learn and conquer.

Lesson 6: Overcome Your Mental Obstacles

- Find a reason greater than reality: the power of spirit.

- List a the "don't wants" first, for they create the "wants"

- Make Daily Choices: The power of choice.

- Invest in education first.

- Choose friends carefully: the power of association.

- “Friends who have no money have never come to ask me how I did it, but they do come asking for one of two things, or both: a loan, or a job."

- Pay your advisors well: the power of good advice.

- “An intelligent person hires someone who is more intelligent that he is.”

- Attorneys, real-estate brokers, accountants, and stockbrokers.

- They are the eyes and ears in the market.

- Look for someone who wants to buy first.

- “Buy the pie, and cut it in pieces. Most people look for what they can afford, so they look too small. They can only buy a piece of the pie, so they end up paying more for less. Small thinkers don't get the big breaks.”

In A Nutshell: Rich Dad Poor Dad

- Most people never win because they're more afraid of losing.

- The poor and the middle class work for money. The rich have money to work for them.

- Traditional schools focus on academic and professional skills, not on financial skills.