Universal Basic Income (UBI) Explained: Free Money For Everyone?

How Could You Benefit? Universal Basic Income (UBI) is an unconditional periodic cash payment paid to all citizens without employment requirements

UBI Explained

Would You Get $12,000 A Year For Free?

What is UBI and How Could You Benefit?

Universal Basic Income (UBI) is an unconditional periodic cash payment paid to all citizens without employment requirements (Floyd). UBI has five main characteristics:

- Unconditionality: to have no strings attached to spending requirements.

- Universality: the right for all citizens to receive UBI.

- Individuality: individual payments made to citizens.

- Cash payment: a tangible medium of currency.

- Regularity: a periodic amount of funds received at constant intervals.

The History of UBI

The phrase “basic income” was introduced by economist George Douglas Howard Cole in 1953 (Widerquist). In his book “Guild Socialism Restated”, he writes: “It has always appeared to me only right that all the citizens should share in the yield of this common heritage, and that only the balance of the product after this allocation should be distributed in the form of rewards for, and incentives to, current service in production” (Cole). However, his work was not recognized until the second wave of UBI was initiated in the 1960s when President Richard Nixon and many prominent economists agreed that a “basic income” was a better proposal for poverty than the conditional programs of the ‘New Deal’.

In August 1969, Richard Nixon disclosed the Family Assistance Plan (FAP), where a family of four would receive $1600 annually from the federal government, equivalent to $10,500 in 2016. President Lyndon B. Johnson’s War on Poverty program inspired FAP, which enlarged American’s access to welfare, especially for the low-income class.

In recent years, UBI was the centerpiece of Andrew Yang’s 2020 presidential campaign, in which he advocated a guaranteed income of USD 1,000 a month in response to the working displacement driven by technological automation. “We need a new economy that puts people first, and the first step to this new economy is a UBI funded by a new tax on the companies that benefit most from automation and the high-income group”, says Mr. Yang (Yang).

Case Studies in South Korea

In South Korea, Gyeonggi Governor Lee Jae-Myung has adapted the concept of UBI into the “Gyeonggi Province Disaster-related Basic Income”. The program costs approximately 260 billion dollars annually to fund $430 to all its citizens monthly. It has been available for 13 million people regardless of age or income level since the coronavirus pandemic.

Gyeonggi Pay contributes to the vitalization of the consumer economy as it was complemented with additional coronavirus stimulus payments. Businesses that accepted Gyeonggi Pay saw their sales increase by 45%. Each transaction is funneled back to the Gyeonggi government headquarters, where officials analyze data to observe the spending patterns. “Even with a small sum of money, we saw that it increased sales for small businesses, especially at places like traditional markets, and it led to their revival”, says Lee Jae-Myung.

Unlike unemployment benefits that have limited access over time, these payments would be a stable flow of income. He plans to fund it through a “robot tax” on factories that have automated their labor force. However, this policy has a loophole that enables locals to save their own money on international goods and services. Although Governor Lee’s political opponents believe money should not be given to high-income earners as the program would be too expensive, Governor Lee believes that all tax-paying citizens have the right as “it’s not a welfare policy but an economic policy” (Prodigy).

The popularity of the local program has now drawn international attention because South Korea has the world’s highest robot density, at 631 robots for every 10,000 human workers. This is eight times more than the global average. The success of South Korea’s Gyeonggi Pay would greatly determine how other countries consider implementing their own UBI.

Case Studies in Kenya

In Keyna, researchers are partnering with GiveDirectly, an international NGO that makes unconditional cash transfers to poor households in developing countries, to explore the long-term impacts of UBI. Under this program, the villages of Magawa in rural western Kenya received $22 a month for four years.

For Benter Wandola, a 67-year-old great-grandmother, this UBI is an unimaginable freedom from the entrenched patriarchy of rural life in Kenya. The cash transfers break the social bonds that ensure women depend on their husbands because the money is theirs alone. “I no longer have to beg from my husband,” Wandola says. She has invested in dozens of healthy chickens, which she can sell for $5 each.

For Odhiambo, who is a female fish trader and burgeoning live stockholder, she immediately spends around $2 on a motorbike taxi ride to the edge of Lake Victoria and the remaining $20 on any fish she can find: Tilapia, Nile perch, and catfish. Then, she returns to the village and sells them to hungry workers. With this method, she can double her money. The money is put in several informal investment groups she is part of.

The behavior of the residents debunks the stereotypical perceptions of a UBI: the low-income group will reduce their work effort and spend their money on alcohol or tobacco. Instead, these evaluations have documented improvements in many outcomes, including food security and educational attainment, investment in small businesses, and long-term earnings.

While these basic income experiments cannot model all the features of UBI, they can accurately model the unconditionality of the UBI payments to move the emphasis away from existing conditional welfare states to four aspects:

- Anti-poverty rationales in countries with higher poverty levels.

- Self-motivation and socio-psychological causes develop positive motivational impacts for the recipients to practice controlling resources about labor market participation.

- Administrative efficiency by replacing the ineffective existing welfare programs.

- Preparing a new social protection model due to the modernization of automation and technological unemployment.

Is UBI Economically Feasible?

UBI is viewed as a utopia by the opposition due to the cost-ineffectiveness objection of UBI. A significant criticism of UBI is the lack of discussion on the funding by advocates who turn a blind eye to the economic realities, particularly the deregulatory tendencies in global economic development.

Some economists argue interest on loans may increase substantially over the following years and lead to a significant increase in debt problems with the divestment of finance institutions from the productive sector. However, many UBI proposals indicate the opposite: conservative and libertarian proponents propose funding by eliminating the entire welfare state and cupp bureaucracy, while moderate libertarian proponents propose funding by only eliminating anti-poverty programs. The remainder would be funded through cuts to non-transfer government expenditures or through increased taxes.

The first method is to impose robot taxes, which target companies that most benefit from technological unemployment. This is to prevent income polarization that threatens the jobs of low- and lower-middle-income workers who cannot enter high-demand knowledge-based fields. However, robot taxes are also controversial for opponents who argue such measures will stifle innovation and impede the economic growth that technology has consistently brought in the past.

The second method is to increase taxes for the high-income class since most economic growth benefits have gone to the wealthiest few percent. According to a 2019 report by Credit Suisse Research, 44% of the world’s wealth is owned by the richest 1%. However, they also found that every extra dollar to wage earners would add about $1.21 to the national economy, while every extra dollar going to high-income earners would only add about $0.39 (“2019”). With the proper transfer of funds and tax regulations imposed by the government, UBI might be economically feasible.

Short-Term & Long-Term Effects of UBI

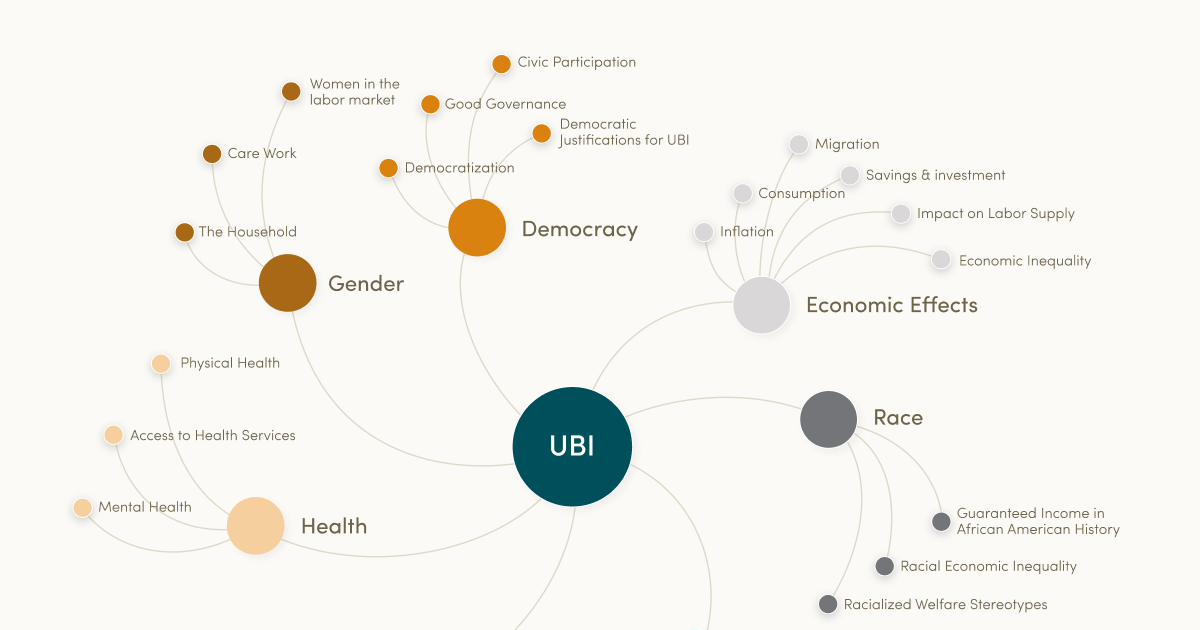

UBI has received global attention for its potential to eliminate extreme poverty, reduce economic inequality, and aid low-income workers in the face of technological unemployment. Most UBI advocates agree that a UBI must be set at or above the poverty line as it enables some low-income individuals to escape the poverty cycle. However, critics of UBI denote that the wealth disparity will increase for the remainders trapped in the poverty cycle as anti-poverty charities may disband as people would no longer see the need to aid them.

Regarding equality, a UBI of $1000 monthly may seem sufficient in the countryside, but it has less value in expensive metropolitan areas. However, as UBI is an adaptable system, the payment varies for different places as the local values and living costs are unique. Although there will still be a visible wealth gap between the rich and poor, a UBI can decrease the working stress levels and provide enough leverage for minimum wage earners to demand better working conditions in unfulfilling labor for a significant part of the population.

Employees would have enough bargaining power to demand higher wages as Annie Lowrey says, “Why take a crummy job for $7.25 an hour when you have a guaranteed $1,000 a month?” (Lowrey). Although critics believe UBI may reduce people’s incentive to work, UBI experiments in Canada indicated that only 1% of the recipients stopped working, primarily to care for their children or spend more time with friends and family. On average, people reduced their working hours by less than 10% to return to school or find better jobs (Advisors). Based on a 2013 study by the World Bank, the belief that poor people would waste their handouts on tobacco and alcohol is false because the lazy and drunk poor person is a stereotype rather than reality.

To What Extent Is UBI Fair?

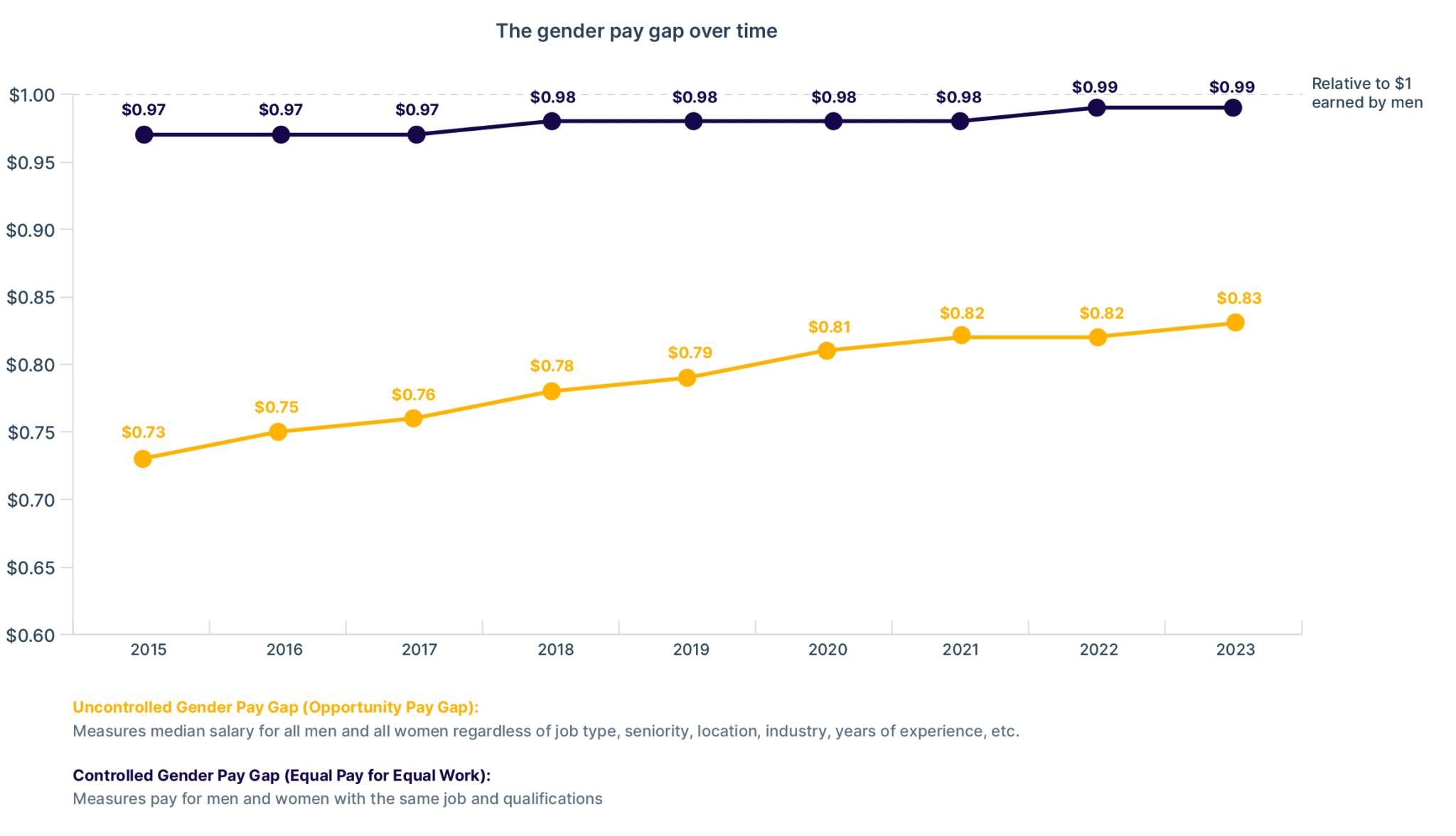

Capitalist countries are built based on the ideology that a capitalist earns the highest profit by efficiently utilizing capital goods while producing the highest-value goods (Staff). With a UBI, the unemployed will receive an income, making money a birthright to all citizens. But this contradicts the ideology of capitalism. Some people also believe that it would be unfair for high-income families to receive a UBI as UBI is not directly targeted at the lower-income class. However, to close the racial wealth gap, a UBI can cease the transmission of racial economic advantage or disadvantage across generations. Black racial groups, especially women, who earn $0.75 for every dollar a white man makes, would ultimately receive the same payment as everyone else.

UBI will provide equal financial opportunities for racial and ethnic groups often discriminated against and subsequently offered lower wages. It can contribute to greater equality and stability in social connections to create a fundamental basis for societal cooperation (Haagh).

Do We Need UBI?

As technological unemployment is gradually reducing the demand for human labor, unemployment benefits are playing an increasingly important role. According to the European Social Survey in 2016, support for UBI averaged approximately 50% in European countries. However, UBI is more favored in the younger than the older generation: 61.3% of responders aged 15-34 support universal basic income compared with 43.2% of those over 65. In particular, the unemployed, lower-income class, and those in education tend to be more supportive of UBI. Nonetheless, there was an apparent dissatisfaction with the existing conditional welfare systems among all age groups, which was a key driver for UBI supporters.

Most of the current welfare systems were inaugurated postwar to reestablish the economy of many countries, especially in the United States. Hence, they are outmoded by the rising technological unemployment of the digital era. For example, five of the six major welfare programs in the United States were inaugurated before the digital revolution in the 1980s: Medicaid, Food Stamp Program, Supplemental Security Income, Housing assistance, and Earned Income Tax Credit (“Welfare”). These existing welfare systems should be replaced with new designs as the world enters the digital era.

UBI In A Nutshell

In the face of a lowered demand for labor due to a foreseeable mass technological unemployment, the world will need to choose how to provide everyone with more equal opportunities in the economy and society. UBI is a potential solution to technological unemployment and economic inequality as it has five main characteristics that differentiate it from existing welfare states: unconditionality, universality, individuality, cash payment, and regularity so that the world is prepared when mass technological unemployment occurs.