How to Analyse a Business: The 5 Keys to Value Investing

The first key to value investing is understanding the business: how the industry works, the company's quality, and some red flags to look out for.

The first key to value investing is understanding the business: how the industry works, the company's quality, and some red flags to look out for.

But first Dennis talks about Mutual Series Funds’ approaches:

- Pure value opportunities, such as identifying significantly undervalued companies or well-run cyclical companies at the bottom of their cycles

- Event-driven opportunities, such as corporate restructurings and spin-offs

- Bankruptcies, mergers and acquisitions

Then, they look for:

- A catalyst

- A margin of safety

- Check the proxy statement to check whether the management’s financial incentives align with shareholders.

The 5 Keys to Value Investing

By J. Dennis Jean-Jacques

Looking at the Mind of the Investor

People are emotional creatures who are driven by fear, greed, and gambling instincts. We often believe what we want to believe, and tend not to take into account what the facts dictate.

Short on courage, we at times lack the conviction from our own work. We are often too short-term oriented.

Overconfidence

Overconfidence may lead investors, often caught up in the moment, to overlook critical facts in their analysis of a situation. Slowly, emotions can take over, as these investors trade in and out of bad investments in a frantic effort to recoup losses, save face, or worse, push their luck during bull markets.

The Internet fuels this danger of overconfidence because of what some call “illusions of knowledge” — the tendency for decision makers to believe that their investment skills increase dramatically simply by getting more information. With so much access to information on a particular company, an overconfident investor can make a case for just about any outcome, no matter how illogical it is — particularly if the information is coming from questionable Web sites. This is a danger for all of us if we lack the training necessary to sift properly through vast amounts of information and inter- pret them appropriately. As a result, many investors rely heavily on Internet chat rooms, news groups, Web postings, and other research.

Concern, Complacency, and Capitulation

The typical investor becomes concerned after the market has dropped or the economy seems to have faltered, which keeps this particular investor from buying good businesses at excellent prices.

Following this logic, after the investor buys at higher prices, he or she gets complacent when the stock continues to rise. This is precisely the time to review the company’s fundamentals. However, this type of investor will generally let it ride. Then finally, when the stock falls on hard times, and the price falls below the purchased price, the investor capitulates and sells on a whim.

Five Questions to Ask When Buying a Stock

- Is this a good business run by smart people?

- What is this company worth?

- How attractive is the price for this company, and what should I pay for it?

- How realistic is the most effective catalyst?

- What is my margin of safety at my purchase price?

An example that Dennis made was Varian Associates, and using the Five Keys of Value framework:

Business: Excellent company with strong market positions, and management teams with a great outlook.

Value: Fair value at $55 per share.

Price: At $33, buying at a 40% discount to fair value.

Catalyst: Breaking up the company.

Margin of Safety: Downside is 12% with a 67% upside potential, getting an entire division for nothing.

Three Approaches to Analysing a Business

Before performing a valuation, we must understand the business, management and industry dynamics. Dennis suggested 3 different approaches:

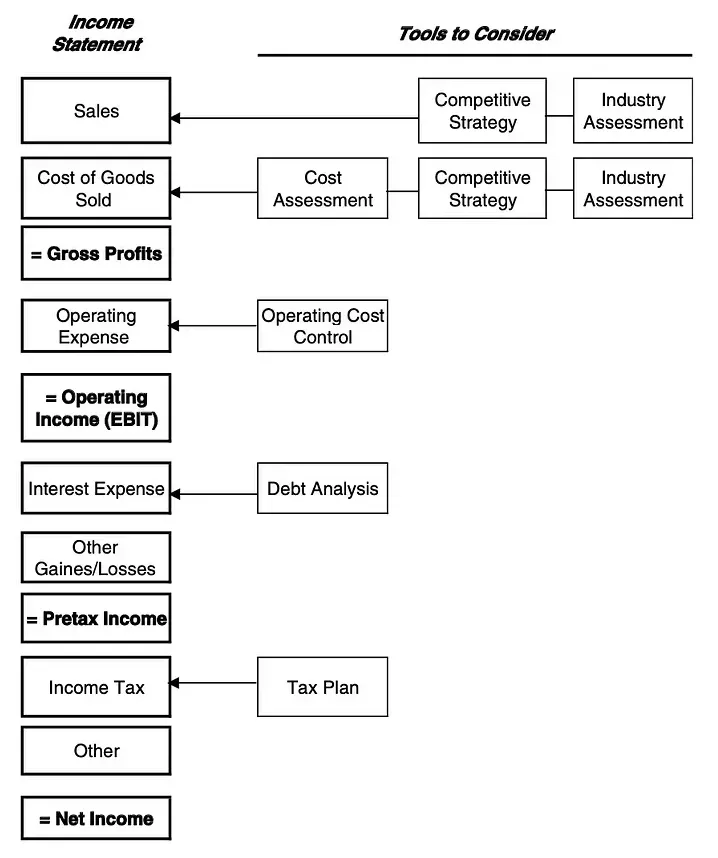

Vertical Assessment Approach

The use of common size analysis in the vertical assessment approach:

- Comparing with competitors by showing all items as a percentage of sales

- Use to analyse the strength and consistency of their margins

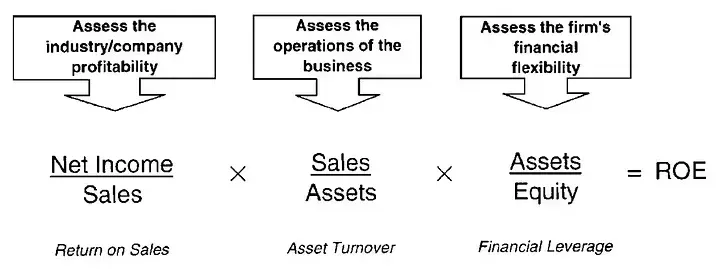

Return on Equity (ROE) Approach

- Used as a relative metric between competitors

- May be subject to constant change due to industry dynamics

Cashflow Based Approach

- What is the relative strength of the company’s internal cash flow compared to its peers?

- Can the company continue to meet its short-term financial obligations without reducing the firm’s financial flexibility?

- What is the trend and use of free cash flow?

- What type of external financing does the company rely on, and does it affect the company’s risk profile?

15 Business Quality Red Flags

- The difference in account policy with competitors in the same industry (e.g. how revenue is recognised). Usually found in the footnotes or the 8-K filing.

- Management’s incentive package is focused on increasing earnings per share and has the discretion over accounting treatment (look at 10-K and proxy statements). This may potentially result in short-term focus, various accounting manipulation and neglect of other metrics.

- There are unjustified changes in estimates, accounting, or financial policies in the 8-K or recent filings.

- There exist special business arrangements and deal structures to achieve accounting objectives, such as earnings growth. (e.g. Off-Balance Sheet Transactions, Creative Revenue Recognition, Channel Stuffing, Income smoothing etc.)

- The Letter to Shareholders does not adequately disclose the company’s business strategy and its economic consequences. (Found in the company’s annual report)

- The management was not complete in addressing the prior year’s poor performance in the MD&A. (Found in the 10-K)

- Any changes in accounting. (Look at footnotes of recent filings)

- There are unexplained transactions that helped earnings. (May be hidden in footnotes)

- There is an abnormally high increase in inventory relative to sales growth. Review the latest income statement, as well as the balance sheet.

- An abnormally high increase in accounts receivable relative to sales. (In the income statement and balance sheet)

- Net income is growing faster than cash flow from operations.

- There is an unexpected and large write-off or charge-off. (See most recent news on the company, as well as the 8-K)

- There is a large fourth-quarter adjustment.

- The company is lending money to customers or has a significant equity stake in its customers. (Look in 10-K)

- The company changes expense calculations or any other material items that can enhance earnings. (See the 8-K and footnotes in 10-Q/K)

Assessing the Management

The management of the company is one of the most important areas to take notice.

“In looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if they don’t have the first, the other two will kill you.” — Warren Buffett

Most investors agree that it’s more of an art form than a science. Professional investors are able to visit and talk with the management, but this is mostly impossible for retail investors. Buffett gives these pieces of advice:

- Read the annual reports of the company and compare them one year to the next

- Check if the management delivered their previous promises.

- Compare the company’s annual reports to its competitors

EVA = After-Tax Operating Income — (Cost of capital x Capital employed)

One approach suggested by the book is using the Economic Value Added (EVA) metric. This metric tests whether the management can generate excess returns with the capital they’ve invested above the cost of their capital.

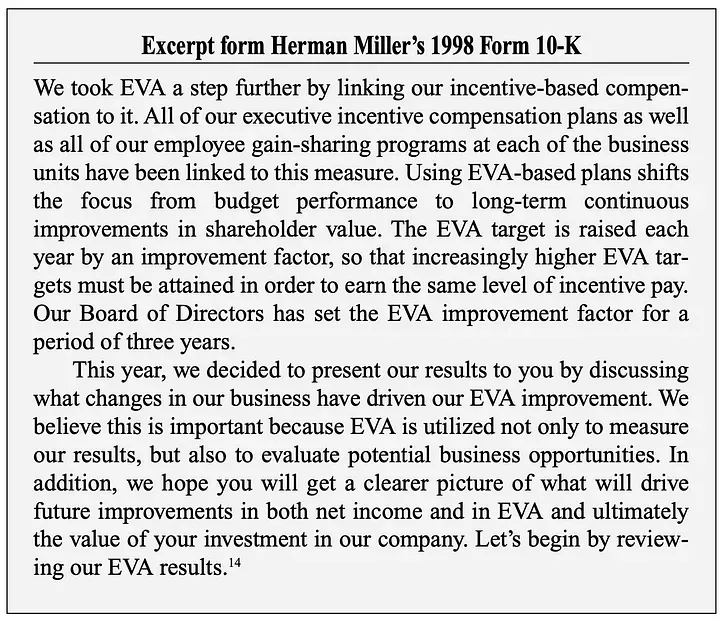

Excerpt from Herman Miller’s 1998 Form 10-K

Simply put, EVA is what remains of profits after tax once a charge for the capital employed in the business is deducted. As an operating discipline, the main advantage of EVA is that it focuses management’s attention on the balance sheet as well as on the income statement.

Our company is, in effect, competing for scarce capital resources. Management’s task is to put this scarce resource to work and earn the best possible return for our shareholders. This means investing in projects that earn a return greater than the cost of the funds sourced from our investors.

As long as we are making investments that earn a return higher than the cost of capital, then our investors should earn a return in excess of their expectations.