Rich Dad's Cashflow Quadrant by Robert Kiyosaki: Book Summary

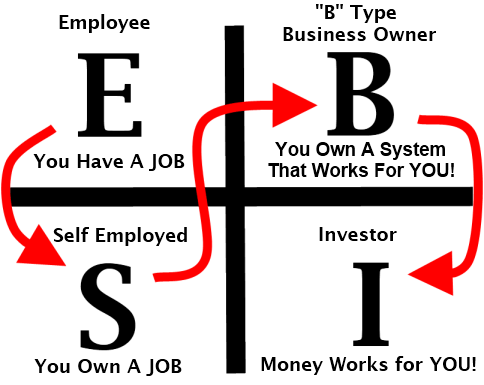

An Employee (E) works for the system. A Self-Employed (S) is the system. A Business (B) controls the system. An Investor (I) invests money into the system.

Rich Dad's Cashflow Quadrant is a guide to financial freedom—the second book of the Rich Dad Poor Dad Series. The Cashflow Quadrant represents the different methods in which people generate income; they reflect our values, strengths, weaknesses, and interests.

The ESBI Quadrant

- An Employee (E) works for the system.

- A Self-Employed (S) is the system.

- A Business (B) controls the system.

- An Investor (I) invests money into the system.

Changing quadrants if often a change at a the core of who you are.

E-Quadrant

- Looks for a safe, secure job with a good pay and excellent benefits (a defined and assured extra compensation).

- Responds to Fear by seeking security.

- Certainty makes them people.

- Security > Money.

- Employees make their bosses and owners rich.

- Debtors make banks and money lenders rich.

- Taxpayers make the government rich.

- Consumers make many others businesses rich.

S-Quadrant

- Works at a fixed rate per hour.

- Enjoys being their own boss.

- Hard-core perfectionists.

- Expects to get paid for their hard work.

- Responds to Fear by taking control of the situation.

- Well-educated professionals (e.g. Doctors, Lawyers, Dentists).

- Sells their businesses at their peak.

- Finds it difficult to delegate because “no one else can do it as good in my way”.

- Respect > Money.

- Success means more hard work.

- Tell them what you want done and leave them alone to do it.

B-Quadrant

- Surrounds themselves with smart people from all four categories: E, S, B, I.

- Likes to delegate.

- “Why do it yourself when you can hire someone to do it for you, and they can do it better?”

- Ownership and control of systems:

- OPT—Other People’s Time.

- OPM—Other People’s Money.

- Ability to bring the best in people.

- Your advisors can only be as smart as you are.

- Have a strong mentor program.

- Develop a business opportunity you can succeed with, believe in, and share confidently with others.

- Success means increasing the system and hiring more people.

I-Quadrant

- I’s invest in B’s.

- Three Types of Investors:

- Type A: Seek problems.

- Type B: Seek answers.

- Type C: Seek an “expert” to tell them what to do.

- Five Levels of Investors:

- Level One: Everything the person buys depreciates in value.

- Level Two: Savers.

- Level Three: “Too Busy” to invest in financial education.

- Level Four: Do-it-yourself investor.

- Level Five: Business owner investing in I quadrant.

The Average Financial Script

- The child goes to school, graduates, finds a job, and has money to spend

- The young adult now can afford to rent an apartment, buy electronics, new clothes, a car, and soon the bill begins to come in.

- One day, the adult meets someone special. They fall in love and get married. For a while, life is blissful because two can live as cheaply as one.

- They save up and buy the dream of all young couples—their own home.

- They find a house, pull their money out of savings and use it for a down payment. Now they have a mortgage.

- Life is wonderful and throw a party to have all their friends over to see their new house, new car, new furniture, and new toys. They’re deeply in debt, but then the first child arrives.

- After dropping the child off at nursery school this average couple must now put their nose to the grindstone and go to work. They become trapped by the need for job security because, on average, they’re less than 3 months away from financial bankruptcy.

Rich Dad's Cashflow Quadrant

By Robert Kiyosaki