10 Most Dangerous Things People Say About Stocks

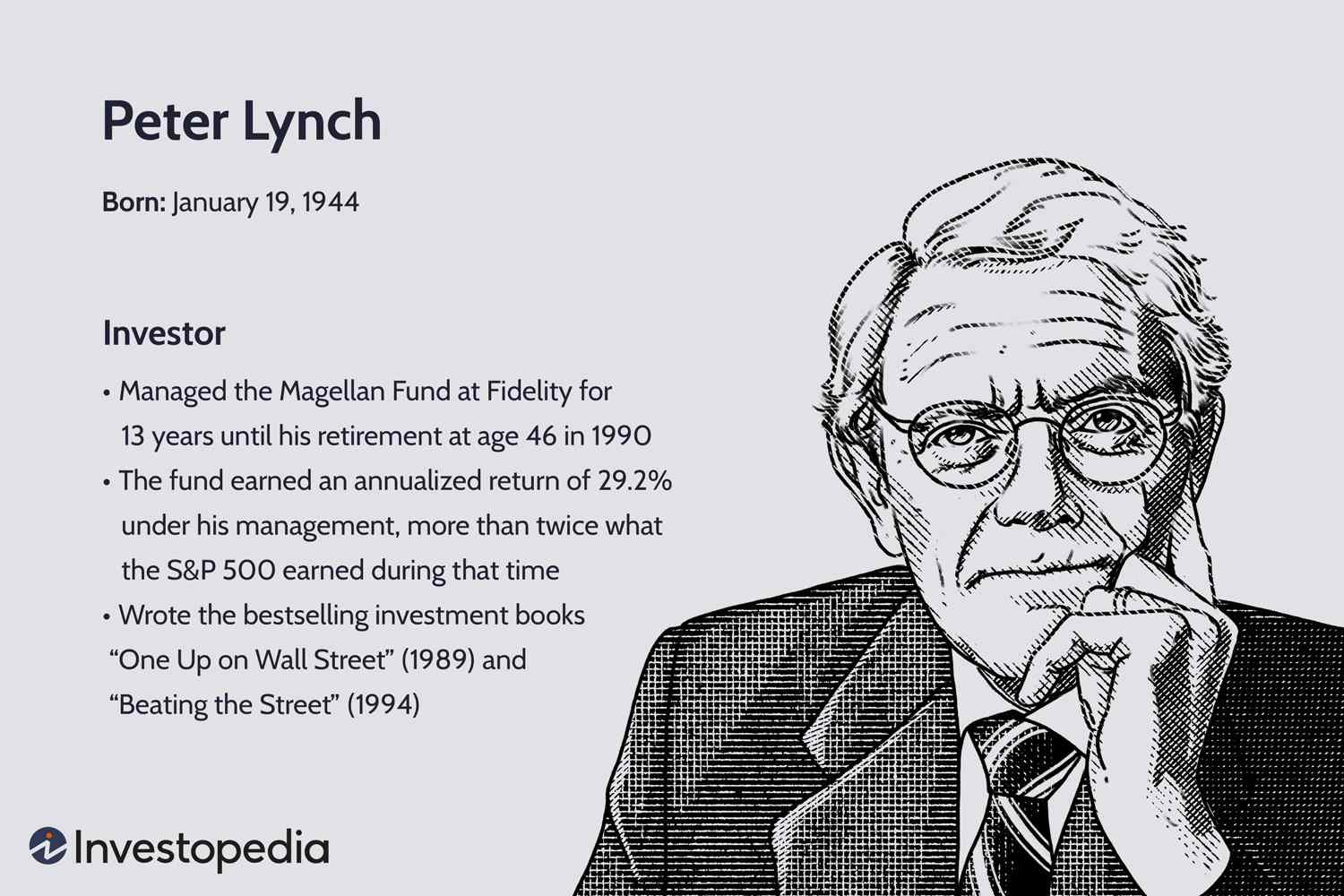

In One Up on Wall Street, the legendary investor Peter Lynch describes the 10 most dangerous things people say about stocks. While Lynch's book was written to offer encouragement to the individual investor, his timeless wisdom remains pertinent to those looking for ten-baggers in a world deluged by Mr.Market's mood swings on what to buy and sell.

1. “The stock went up, so I must be right”

People often take comfort when their recent purchase of something at $5 a share goes up to $6, as if that proves the wisdom of the purchase. Nothing could be further from the truth. Of course, if you sell quickly at the higher price, you've made a fine profit, but most people don't sell in these favorable circumstances. Instead, they convince themselves that the higher price proves that the investment is worthwhile, and hold on to the stock until the lower price convinces them the investment is no good.

If it's a choice, they hold on to the stock that's risen from $10 to $12, and they rid rid of the one that's dropped from $10 to $8, while telling themselves they have "kept the winner and dumped the loser."

Key Takeaway: When a stock goes up or down, it only tells you that there was somebody who was willing to pay more or less for the identical merchandise.

2. “I missed that one, so I’ll catch the next one”

The trouble is that the "next" one rarely lives up to the expectation of its predecessor. If you missed Toys "R" Us, a great company that continuously went up, and bought Greenman Brothers, a mediocre company that went down, you've compounded your error.

Key Takeaway: In most cases, it's better the buy the original company at a high price than it is to jump on the "next one" at a bargain price.

3. “Look at all the money I’ve lost because I didn’t buy it!”

We would all be wealthier today if we put all our money in Microsoft during its initial public offering (IPO) on March 13, 1986, at a price of US$21 per share (which equates to $0.0729 per share today adjusting for stock splits).

Given that Microsoft now trades at $335.92 per share (as of August 1, 2023), you've missed out on a return of 335,820%!

Key Takeaway: Regarding someone else's gains as your personal loss is not a productive attitude for investing in the stock market.

In fact, it can only lead to total madness. The more you stocks you learn about, the more winners you realize that you've missed, and soon enough you're blaming yourself for losing billions and trillions of potential gains.

4. “It’s taking too long for anything to ever happen”

Here's something else that's certain to occur: If you give up on a stock because you're tired of waiting for something miraculous to happen overnight, something wonderful will begin to happen the day after you sell it.

When you begin to think everybody else is right and you are wrong, patience is often rewarded where the fundamentals are promising.

Key Takeaway: It takes remarkable patience to hold on to a stock in a company that excites you, but which everybody else seems to ignore.

5. “What me, worry? Conservative stocks don’t fluctuate much”

Two generations of conservative investors grew up with the idea that you can't "go wrong" with utility stocks. They believed that you could just put these worry-free issues in the safety-deposit box and cash in the dividend checks. Suddenly, there were nuclear disasters and rate-base problems that made utility stocks, such as Consolidated Edison, lose 80% of their value.

Key Takeaway: Companies are dynamic, and prospects change. There simply isn't a stock you can own that you can afford to ignore.

6. “When it rebounds to $10, I’ll sell”

In Lynch's experience, no downtrodden stock ever returns to the level at which you've decided to sell. In fact, the minute you say, "If it gets back to $10, I'll sell," you're most likely doomed to several years of teetering around just below $9.75 before it dives down to $4, on its way to falling flat on its face at $1.

Key Takeaway: Remind yourself that unless you're confident enough in the company to buy more shares, you ought to be selling immediately.

7. “It’s always darkest before dawn”

Many people believe that things that have gotten a little bad can't get any worse. People who invest on freight-car deliveries were shocked when business dropped from a peak of 95,650 units delivered in 1979, to a low of 44,800 in 1981. This was the lowest number of deliveries in 17 years, and nobody imagined it could get much worse, until it dropped to 17,582 units in 1982, and to 5,700 in 1983.

Key Takeaway: Sometimes it's always darkest before dawn; other times, it's always darkest before pitch black.

8. “It’s only $2 a share: what can I lose?”

Many people believe that buying a $2 stock per share is a lot safer than buying a $100 stock per share. However, a lousy cheap stock is just as risky as a lousy expensive stock if it goes down. If you had invested $1000 in a $2 stock or $50 stock and each of them fell to $0, you would lose exactly the same amount.

Key Takeaway: No matter where and when you buy in, the ultimate downside of picking the wrong stock is always 100 percent.

9. “Eventually they always come back”

Consider the thousands of bankrupt companies, plus the solvent companies that never gain their former prosperity, plus the companies that get bought out at prices that are far below all-time highs.

“If I could remember the names, I could give you a much longer list of smaller and lesser-know public companies whose blips have disappeared from the Quotrons forever.”

Key Takeaway: Many companies never turnaround from their once all-time highs.

10. “If it’s gone this high already, how can it possibly go higher?”

Who is Peter Lynch?