The Intelligent Investor by Benjamin Graham — Book Summary and Notes

"The first book ever to describe, for individual investors, the emotional framework and analytical tools that are essential to financial success."

🎯 The Book in 3 Sentences

-

Think for yourself — "Investing isn't about beating others at their game. It's about controlling yourself at your own game.”

-

Have a long-term vision and look beyond the short-term rewards

-

Learn from your mistakes and stay persistent

Benjamin Graham

"The first book ever to describe, for individual investors, the emotional framework and analytical tools that are essential to financial success."

The Intelligent Investor

By Benjamin Graham

Why Should You Invest?

According to Benjamin Graham, "the whole point of investing is not to earn more money than average but to earn enough money to meet your own needs... In the end, what matters isn't crossing the finish line before anybody else but just making sure that you do cross it."

Are You An Intelligent Investor?

Graham defines investment as an operation that, upon thorough analysis, promises the safety of the principal and an adequate return. The intelligent investor is someone patient, disciplined, and eager to learn.

The Intelligent Investor must:

- Think for Themselves

- Harness their Emotions

- Never forecast the future by only extrapolating the past,

- Refuse to compare their financial success to a bunch of total strangers.

This kind of intelligence "is a trait more of the character than of the brain."

1. Think For Yourself

Mr. Market

"Investing isn't about beating others at their game. It's about controlling yourself at your own game.

— Benjamin Braham

Mr. Market's job is to provide you with prices; your job is to decide whether it is to your advantage to act on them. You have the luxury of being able to think for yourself. However, millions of people let Mr. Market tell them how to feel and what to do when it comes to their financial lives.

Why you can perform as well as "Professional Investors"

- With billions of dollars under management, they must gravitate towards the biggest stocks-the ones they can buy in the multimillion-dollar quantities they need to fill their portfolios. Many funds end up owning the same few overpriced giants.

- Investors tend to pour more money into funds as the market rises. The managers use that new cash to buy more of the stocks they already own, driving prices to even more dangerous heights.

- If funds investors ask for their money back when the market drops, the managers may need to sell stocks to cash them out. They become forced sellers as stocks get cheap again.

- If a company gets added to an index, hundred of funds compulsively buy it. (If they don't and that stock then does well, the managers look foolish; on the other hand, if they buy it and it does poorly, no one will blame them.)

- Funds managers are expected to specialize. They must only purchase "small growth" stocks or "mid-sized value" stocks. If a company becomes out of its reach, the funds have to sell it even if the manager loves the stock.

Control the Controllable

You can't control whether the stocks or funds you buy will outperform the market today, next week, this month, or this year. But you can control your:

- Brokerage costs, by trading rarely, patiently, and cheaply.

- Ownership costs, by refusing to buy mutual funds with excessive annual expenses

- Expectations, by using realism, not fantasy, to forecast your returns

- Risk, by deciding how much of your total assets to put at hazard in the stock market, by diversifying, and by rebalancing.

- Tax Bills, by holding stocks for at least one year and, whenever possible, for at least five years, to lower your capital-gains-liability

- and, most of all, your own behavior.

According to Benjamin Graham, "the challenge for the intelligent investor is not to find the stocks that will go up the most and down the least, but rather to prevent yourself from being your own worse enemy-from buying high just because Mr.Market says 'Buy!' and from selling low just because Mr. Market says 'Sell!'."

2. Two Types of Investors

"The Defensive Investor"

"The defensive investor will place his chief emphasis on the avoidance of serious mistakes or losses. His second aim will be freedom from effort, annoyance, and the need for making frequent decisions."

Fortunately, it's never been easier for a defensive investor to buy stocks thanks to the internet. A permanent autopilot portfolio, which effortlessly puts a small amount of your money to work every month in predetermined investments, can save you from the need to dedicate your time to stock picking.

Suggested Trades from Graham Stephan

- Purchase well-established investment funds as an alternative to creating his own common-stock portfolio.

- "Common Trust Funds" from trust companies and banks of a recognized investment counsel firm.

- "Dollar-Cost Averaging": Divide the total amount to be invested across periodic purchases of an asset to reduce the impact of volatility on the purchase (e.g. Automated Monthly Payment)

Favorite Motto: "IDK and IDC"

- If someone asks whether bonds will outperform stocks, just answer, "I don't know and I don't care"—after all, you're automatically buying both.

- What's the next Microsoft? "I don't know and I don't care"—as soon as it's big enough to own, your index will have it, and you'll go along with the ride.

- A permanent autopilot portfolio liberates you from the feeling that you need to forecast the financial markets.

The "Enterprising" Investor

The determining trait of an enterprising investor is his willingness to devote time and care to the selection of securities that are both sound and more attractive than the average. This type of investor could expect a worthwhile reward for his extra skill and effort from a better average return than the "defensive" investor.

To obtain better than average investment results, the enterprising investor.

- (1) must be objective

- (2) must follow policies that sound promising, and are not popular

- (3) must concentrate on the larger companies that are going through a period of unpopularity.

Advantages of Large Companies

- They have the resources in the capital and brainpower to carry them through adversity and back to a satisfactory earning base.

- The market is likely to respond with reasonable speed to any improvement shown.

How much risk are you willing to take?

- Are you single or married? What does your partner do for a living

- Do you or will have children? When will the tuition bills hit home?

- Will you inherit money, or will you end up financially responsible for aging, ailing parents?

- What factors might hurt your career?

- If you are self-employed, how long do businesses similar to yours tend to survive?

- Do you need your investments to supplement your cash income

- Given your salary and your expenses, how much money can you afford to lose on your investments?

3. The Art of Successful Investment

“Obvious prospects for physical growth in a business do not translate into obvious profits for investors.” — Benjamin Graham

By the time everyone decides that a given industry is "obviously" the best one to invest in, the prices of its stocks have been bid up so high that its future returns have nowhere to go but down

Always Remember

- To choose industries that are most likely to grow in the future

- To identify the most promising companies in these industries

- The experts do not have dependable ways of selecting and concentrating on the most promising companies in the most promising industries.

- The investor should not regularly hold off buying until low market levels appear because this may involve a long wait and the possible missing of investment opportunities.

Profiting from Market Fluctuations

- Timing: to anticipate the stock market's action: to buy or hold when the future course is projected upward and to sell or refrain from buying when the future is projected downward.

- Pricing: to buy stocks when they are valued below what they are worth and sell them when they rise above such value.

The Best Funds have in Common:

“Yesterday’s winners are often tomorrow’s losers” — Benjamin Graham

- Their managers are the biggest shareholders.

Managers who manage the money as if it were their own.

2. Have Low fees.

High returns are temporary, high fees are permanent

3. They shut the door.

Stops the feeding frenzy of new buyers who want to pile in at the top.

4. They don't advertise

Behave as if they don’t want your money. They don’t constantly appear on financial television or run ads boasting of their No. #1 Returns.

5. Marathoners, not Sprinters

Pride themselves on being careful, conservative, and competent.

🚫 Red Flags to Look Out For

- A sharp and unexpected change in strategy

- An increase in expenses, suggesting that the managers are lining their own pockets;

- Large and Frequent Tax Bills, generated by excessive trading;

- Suddenly Erratic Returns, are when a formerly conservative fund generates a big loss or even produces a large gain.

- "Merger" costs in which a tiny firm took over a big one

- "Charges for the impairment of long-lived assets"

- "Write-offs of purchased in-process research and development"

- Companies are repeatedly split their shares and hype those splits in breathless press releases

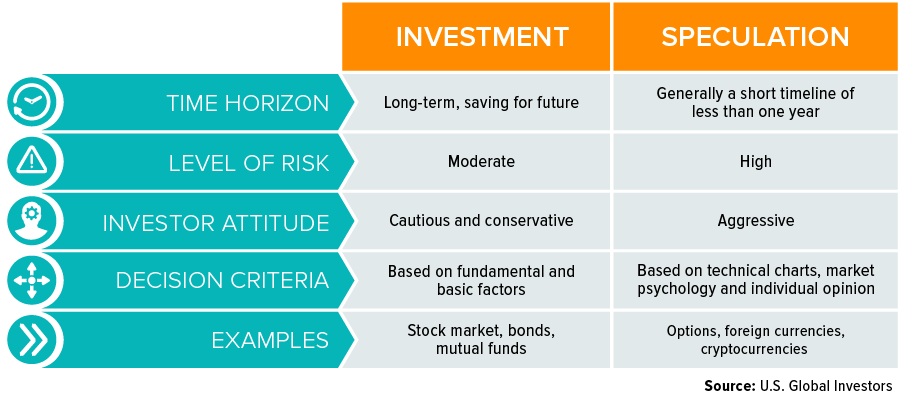

4. Investment v.s. Speculation

"People who invest make money for themselves; People who speculate make money for their brokers."

— Benjamin Braham

Investment

Investing is the act of buying and holding an asset for the long term. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices in the long term. To classify it as a long-term holding, the investor must own the asset for at least one year.

Speculation

Speculating is the act of putting money into financial endeavors with a high probability of failure. A speculator gambles that a stock will go up in price by making an educated guess. Like casino gambling, speculating in the market can be exciting or even rewarding.

What is the Difference?

- Level of risk undertaken

According to Benjamin Graham, "the people who take the biggest gambles and make the biggest gains in a bull market are almost always the ones who get hurt the worst in the bear market that inevitably follows. Being "right" makes speculators even more eager to take extra risks, as their confidence catches fire. And once you lose big money, you then have to gamble even harder just to get back to where you started."

In A Nutshell

Losing some money is an inevitable part of investing, and there's nothing you can do to prevent it. Risks exist in another dimension: inside you. If you overestimate how well you really understand an investment, it doesn't matter what you own or how the market does. Ultimately, financial risk resides not in what kinds of investments you have but in what kind of investor you are. However, an intelligent investor must take responsibility for ensuring that you lost the least amount of money possible. To be an investor, you must be a believer in a better tomorrow. At heart, "uncertainty" and "investing" are synonyms. Have the courage of your knowledge and experience, and hesitate not to differ from others.

Quote Bank

"All investors labor under a cruel irony: we invest in the present, but we investor for the future. And, unfortunately, the future is almost entirely uncertain. Therefore, investing on the basis of projection is a fool's errand; even the forecasts of the so-called experts are less reliable than the flip of a coin. For most people, investing on the basis of protection from overpaying for stock and overconfidence in the quality of their own judgment is that the best solution."

— Benjamin Graham

"The happiness of those who want to be popular depends on others; the happiness of those who seek pleasure fluctuates with moods outside their control, but the happiness of the wise grows out of their own free acts."

— Marcus aurelius

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

— Warren Buffet

"The fault, dear investor, is not in our stars—and not in our stocks—but in ourselves..."

— Benjamin Graham